Accelerate business process automation with low-code

Ensure rapid automation and robotization of the most complex processes and workflows by combining data, people, business rules, and technology. Automate repetitive tasks and focus on innovation.

Address the challenges of banking process automation using the low-code development platform

Take an evolutionary approach to automation

Processes with low repeatability that can be handled manually are not a priority in terms of automation. As far as highly repetitive processes, some just need to be robotized without integrating them with services provided by external systems, and others are worth automating and optimizing.

- These approaches can be mixed within a single process. Complex processes may contain steps that can be automated and optimized, those that are ideal for robotization, and those that are better left to humans.

The benefits of automating

business processes with low-code

Easy integrations

Fast and cost-efficient automation

Effective optimization thanks to statistics

Frictionless business processes

Reusability and composability of solutions

Process supervision and easier troubleshooting

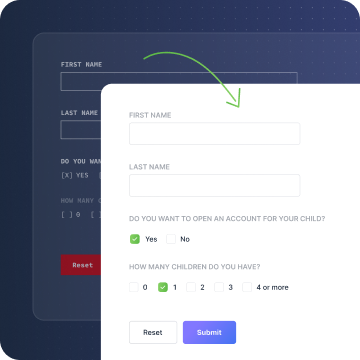

Business Account Generator at Credit Agricole

Opening a business account is one of the fundamental steps for entrepreneurs starting their business and an opportunity for the bank to make a positive first impression, laying the foundation for a lasting relationship with business customers.

Therefore, modern banking requires advanced tools that support employees in providing the best possible customer service.

3-step implementation of the Eximee

low-code platform

How to implement Eximee in a bank?

Step 1

Discovery meeting

We discuss the current state of your processes, digitization and automation capabilities, and possible solutions.

Step 2

Analysis

Together we choose the process to digitize and develop a plan.