Michał Stolarski

Michał Stolarski

Banks are increasingly interested in automating their processes, and the focus on BPMS (Business Process Management Systems) platforms is a key part of this trend. In this article, we’ll explore why BPMS platforms are gaining traction and the benefits of integrating them with low-code solutions.

A survey by Camunda found that 82% of the 600 IT professionals surveyed identified process automation as a top priority within their organizations, particularly highlighting its importance during the pandemic. This drive towards automation is largely motivated by the need to keep pace with a growing market and to meet rising consumer expectations.

First, let’s explain what process automation is and why it is fundamental in the banking sector. Banking process automation, or business process automation, refers to using software to automate and streamline repetitive tasks, workflows, and processes. There are many benefits to implementing automation, for instance:

Increased efficiency – automation streamlines and optimizes banking processes, such as customer onboarding, loan processing, payments processing, and account reconciliation, resulting in improved operational efficiency. Automated processes can reduce delays, leading to faster processing of tasks and improved productivity.

Improved accuracy and security – automation reduces the likelihood of human mistakes by minimizing manual data entry and running data validation processes, which results in improved accuracy and quality of work, less rework, lower risk of compliance violations, and significantly increased customer satisfaction. Moreover, automated processes are easier to understand, maintain and fine-tune in the future.

Enhanced scalability and flexibility – automated processes can easily handle huge volumes of transactions and large numbers of customers without significant changes to the system. It allows banks to be more agile and responsive to market dynamics.

Increased visibility and control – automation means better visibility and control over banking processes through real-time monitoring, reporting, and analytics. It enables data-driven decisions, quick detection of process bottlenecks, and support for process optimization.

Enhanced customer experience – automation improves the overall customer experience by reducing processing times and providing faster and more accurate responses to customer requests. It enables self-service options and automated customer support, leading to improved customer satisfaction and loyalty.

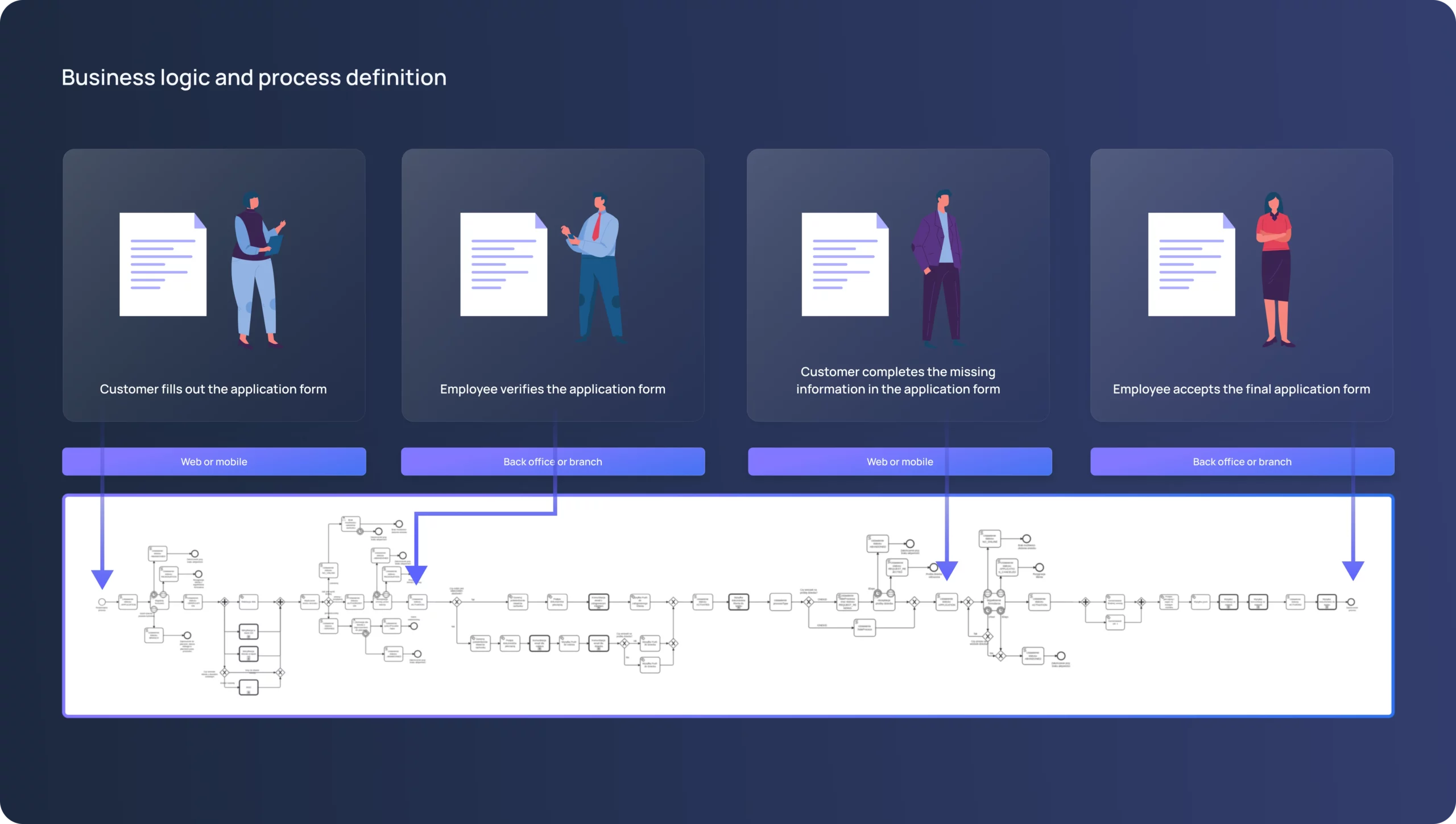

BPMS (Business Process Management System) is the natural choice for digitizing complex business processes. BPMS platforms typically provide a user-friendly interface that allows business analysts, process designers, and other stakeholders to create, analyze, and optimize business process models using BPMN diagrams.

Apart from process automation, BPMS platforms may also offer additional features, such as process simulation, monitoring, collaboration, and reporting.

If your bank has a centralized BPMS, developing multiple processes simultaneously by different teams is very difficult. However, it is possible to treat a BPM platform as a local solution maintained and developed as part of a project that requires the use of a tool of this type. Such an approach allows independent development and maintenance of the implemented processes.

Moreover, BPMS platforms available on the market do not offer:

It does not mean there is no solution to this situation – there is, and it is called the Eximee low-code platform.

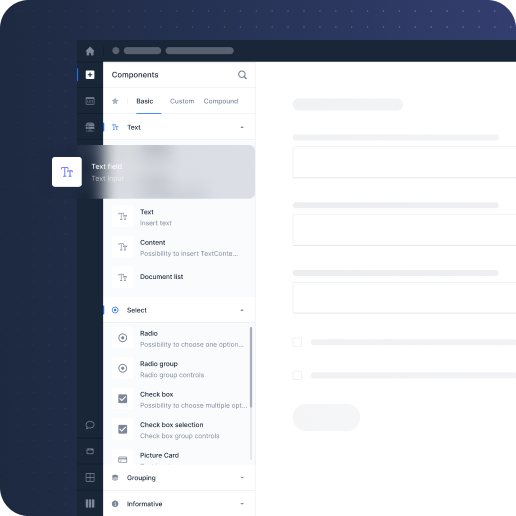

The Eximee low-code platform is a development tool that enables the creation of applications with minimal coding, using a visual interface with drag-and-drop functionality.

It enables users to model processes, define data models, and configure business logic. It provides a library of pre-built components, templates, and connectors to integrate with various data sources and external systems.

Eximee low-code platform is a way to bridge the gap between business requirements and IT implementation, allowing for faster development and delivery of custom applications.

Why use a BPMN engine combined with the Eximee low-code platform? One of the many advantages of this solution is that it leverages the BPMS where it fits most naturally, while also extending the capabilities of BPMN 2.0.

It is crucial to state that the implementation of such a combination does not involve changing the entire infrastructure. We promote using an existing workflow engine (e.g. Camunda) and integrating it with the Eximee low-code platform.

If you do not have an implemented BPMS, we provide a pre-configured Camunda instance with deployment scripts or ready-made containers that allow you to launch the environments for quick development and production use of the applications you create.

Other benefits of this approach include:

The Eximee platform provides more than 100 ready-made front-end components. The resulting forms are not only functional and aesthetic, but also responsive and in line with design best practices and WCAG 2.1 accessibility guidelines.

Reusable components with defined business logic allow the creation of dynamic forms with specified conditions and dependencies between the elements. They can contain formatters and data validators and may be integrated with internal and external systems. For even greater flexibility, more extensive business logic can be implemented using ScriptCode. If necessary, you can create your own components and add them to the library on the platform.

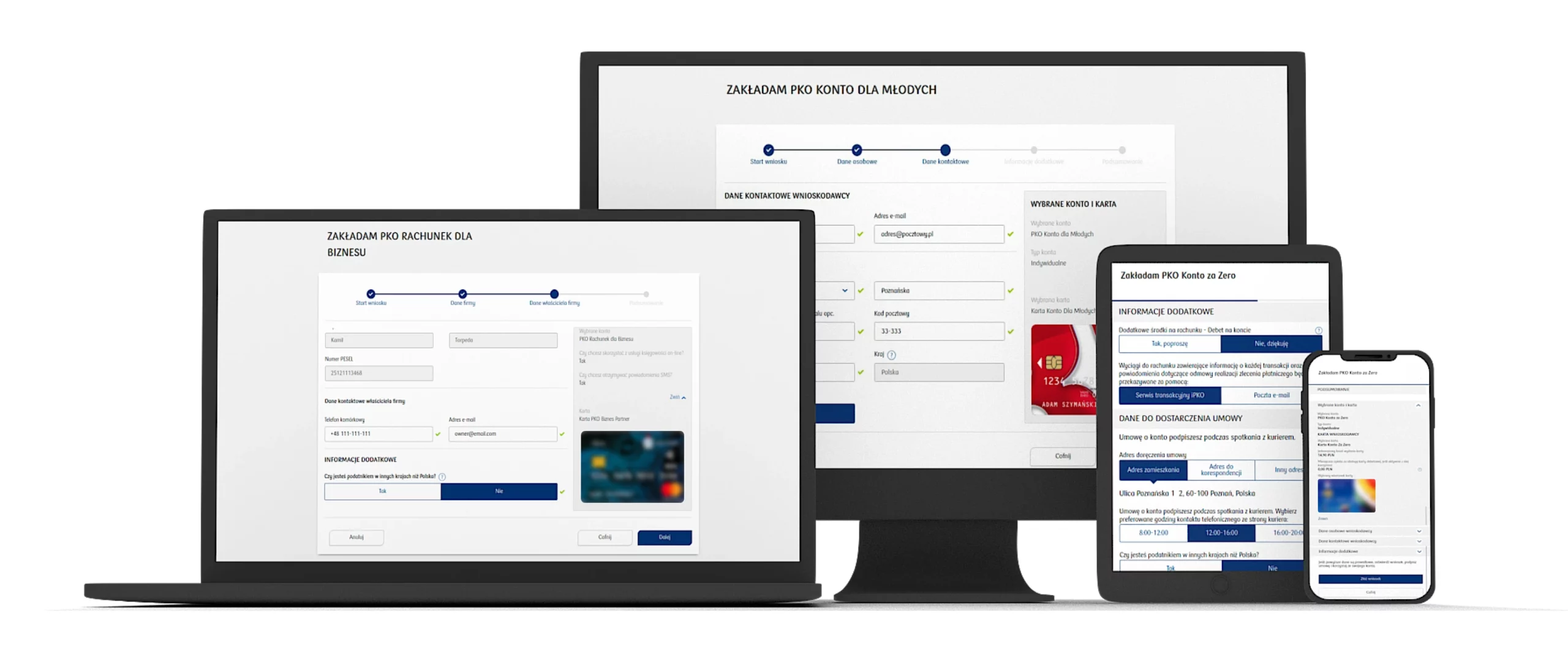

Digital processes developed with the Eximee platform can be deployed across desktop, mobile, in-branch, and call center applications. Eximee ensures seamless process continuity across channels, allowing customers to start filling out an application on a website, and complete it later on in a mobile app, without losing any data.

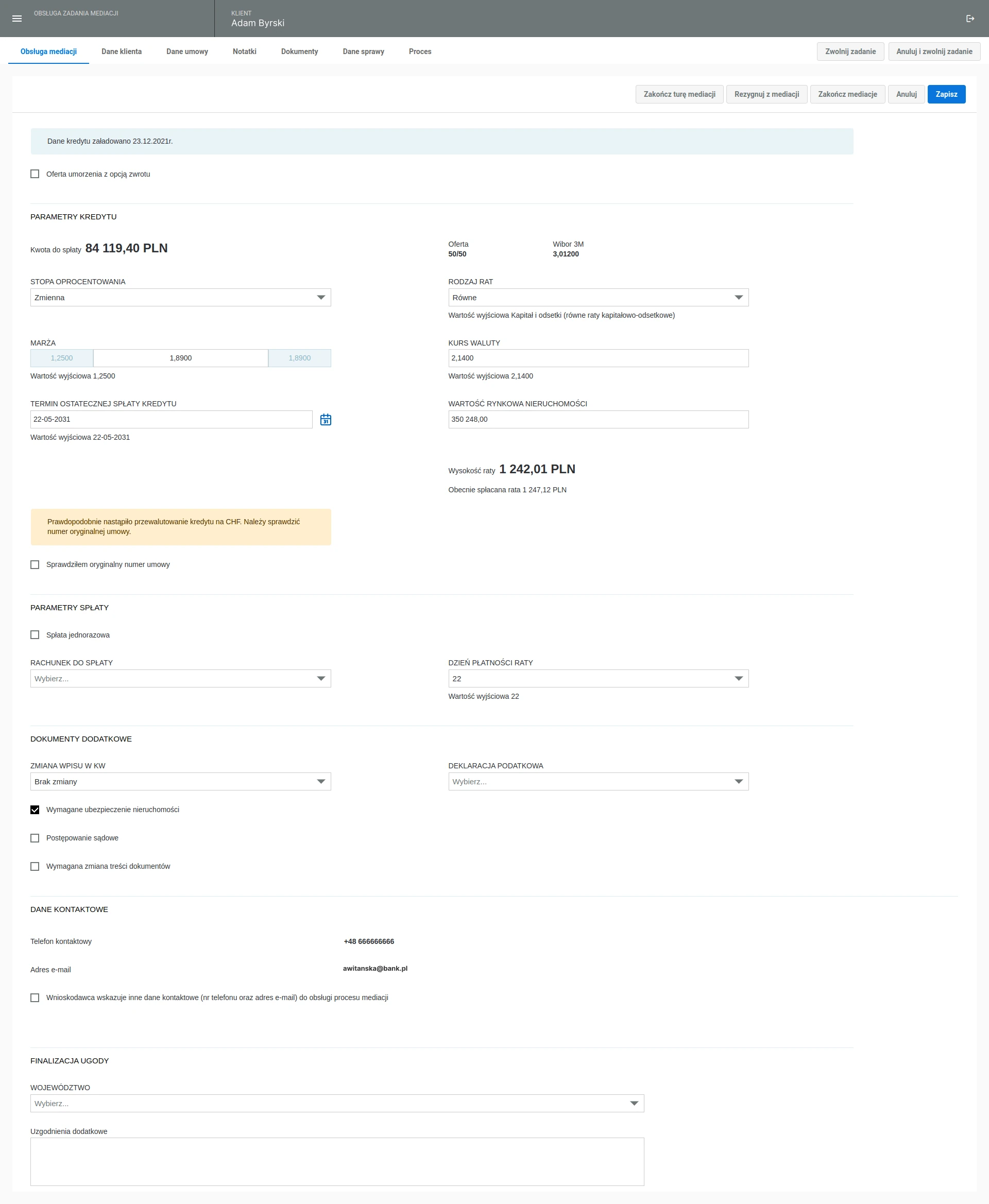

With extensive forms and omnichannel capabilities, it is possible to design functionalities that support realization of user tasks.

They can be made available to both customers, e.g., in e-banking or mobile banking, and to bank employees, e.g., in CRM. Who is to execute the task associated with a given step in the process is determined within the process definition in BPMN.

The functionality doesn’t need to be limited to a form designed in the Eximee Designer as it can include embedded pieces of applications that support the execution of user tasks.

The example below is a screen for changing loan conditions. It shows a dedicated functionality for managing appointments (on the left) and a form for setting loan parameters.

You can define the layout and tabs and integrate applications for taking notes or managing documents needed in a process.

Maintaining strict vigilance over deadlines for process-driven tasks is critical for banks. However, the sequence in which employees claim tasks depends not only on explicit deadlines (e.g., customer documents requiring verification within 3 days) but also on the process type, customer segment, case status, and many other factors.

Notifications sent from the processes remind users about deadlines, while business escalation paths defined in the process help keep due dates and time commitments under control.

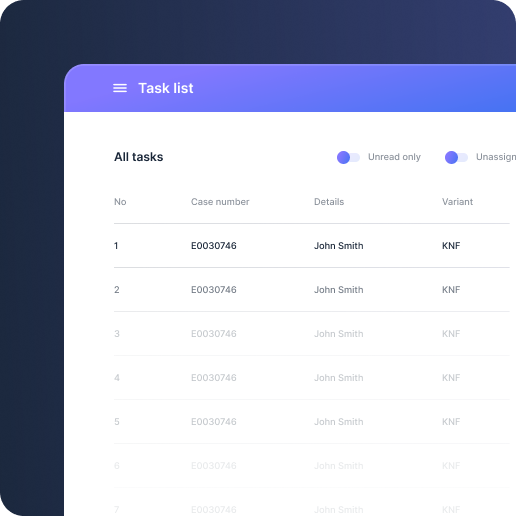

The task list plays a vital role in facilitating efficient task management by enabling filtering, sorting, and providing prompts for task sequencing.

The Eximee low-code platform extends the BPMS engine with parameterizable and flexible task lists. When parameterizing the process, it is possible to:

Moreover, Eximee supports:

The case list is a comprehensive overview of all cases (both open and closed) with sorting and filtering capabilities. You can configure the list by defining which data should be displayed for each process or group of processes.

The detailed case overview includes customizable case details, case history, and downloadable documents generated during the process.

The case overview can be extended with plug-ins to display information from a customer’s file, communication history, or customer appointments.

Eximee allows for the creation of applications that are accessible online to both logged-in and non-logged-in users. However, the workflow engine only initiates a process once a user confirms the form submission or provides personal information that the bank can use to contact them with an offer.

This approach reduces the load on the BPMS engine by avoiding the maintenance of cases with no real business value. It also shields internal systems from the strain of processing application entries made out of curiosity or by mistake, which are unlikely to convert.

However, it’s important to address situations where a customer fills in their contact information but does not finish completing the form and. If the case does not find its way into BPMS, the bank might never know about the prospect. This is where the abandoned application form handling mechanism comes into play. It notifies the bank of the attempted form completion and enables the call center, for example, to reach out to the customer and potentially close the sale.

Some activities do not need BPMS support at all, for instance:

In such cases you can still use the Eximee low-code platform and embed all the necessary business logic within the Eximee forms.

The Eximee platform enables the integration of existing data-producing or data-consuming systems into the developed processes. To connect with a specific service and access required data, you may use pre-built connectors or create new ones tailored to your needs. The integration elements can be reused across various layers, including interfaces and business logic. Additionally, Eximee allows the separation of process logic and data processing from the components responsible for integrations.

Moreover, the platform supports data and services in any technology, whether it’s SOAP, REST, MQ queue, or even older technologies. This makes it versatile in accommodating different setups and allows you to integrate external systems through APIs.

As for the front-end layer, it seamlessly integrates with various applications like websites, CRMs, or native mobile banking applications.

Eximee offers a dashboard for business administrators, which enables them to:

The platform also simplifies the work of business analysts with process definitions, allowing them to integrate complete applications into a runtime environment and easily migrate them to higher environments.

Microprocesses are small, self-contained processes that typically perform a specific task or activity and are designed to be highly modular and reusable. Microprocesses offer several benefits, such as increased consistency, flexibility and agility in process design as well as improved scalability and maintainability. They can be developed independently, and then combined as needed to create more complex processes. It helps streamline the development and modification of processes.

A good example of a reusable microprocess can be a microprocess that sends emails. Dealing with emails consists of several steps such as sending, receiving and reacting to various mail server responses and providing status to the main process.

An undeniable advantage of the Eximee platform are data models. A data model is a structured data definition that serves to two main purposes:

Moreover, the consistency of the developed processes is reflected in coherent UX solutions (e.g. collection – this means that of personal and address data, income sources, etc.).

As the demand for process automation continues to rise, the synergy between BPMS and low-code platforms like Eximee will play a crucial role in shaping the future of banking.

By leveraging the strengths of both BPMS and low-code platforms, banks can achieve greater flexibility, streamline complex workflows, and ensure consistent data management across all processes. The Eximee platform’s extensive front-end components, comprehensive integrations, and task management features further empower banks to adapt quickly to changing market demands while maintaining stringent control over their processes.

Ultimately, this integrated approach enables banks to innovate faster, reduce operational costs, and stay competitive in an increasingly digital landscape.

Business process automation in banking refers to the use of software to automate and streamline repetitive tasks, workflows, and processes, improving operational efficiency, accuracy, and customer experience.

Business process automation is crucial for banks as it increases efficiency, reduces errors, enhances scalability, provides better visibility and control over processes, and improves the overall customer experience.

A Business Process Management System (BPMS) is a platform that helps in digitizing and automating complex business processes by allowing stakeholders to create, analyze, and optimize business process models using visual tools like BPMN diagrams.

BPMS platforms can be challenging to use for multiple teams developing processes simultaneously, and they often lack flexible task lists, multichannel forms, seamless integration capabilities, and effective collaboration tools between business analysts and developers.

The Eximee low-code platform enhances BPMS by providing complex forms with top-notch UX, omnichannel capabilities, flexible task management, comprehensive integrations, and control over the process, making it easier to manage and optimize banking workflows.

Combining BPMS with the Eximee low-code platform allows banks to create complex, scalable, and flexible processes with enhanced user interfaces, better task management, and seamless integration across various systems and channels.

Eximee ensures process continuity across multiple channels, such as desktop, mobile, in-branch, and call center applications, by enabling customers to start a process on one channel and continue it seamlessly on another without losing any data.

Eximee supports task management by offering flexible and parameterizable task lists, handling tasks by multiple users, live status previews for supervisors, and management of replacements for absent employees.

Microprocesses are small, self-contained processes designed to be modular and reusable. They benefit banks by increasing consistency, flexibility, scalability, and maintainability in process design.

Eximee facilitates integration with existing data-producing or data-consuming systems through pre-built connectors or custom integrations, supporting various technologies like SOAP, REST, and MQ queues, making it versatile in different banking setups.