Is it possible to get the loan application process up and running in 2 weeks? We have proven it is. We have digitized the application process for Safe 2% Mortgage in SGB Bank S.A. and other community banks in SGB group. The programme was launched in Poland in July 2023 by the Ministry of Development and Technology. To achieve this in such a short period of time, we used the potential of low-code.

Speech by Piotr Koliński as part of the Digital Banking Academy (in Polish)

Safe 2% Mortgage is the government's preferential mortgage project that gives young people in Poland a better chance of owning their own house or apartment. To obtain a loan, at least one applicant must be under 45 years of age. Borrowers will be entitled to a subsidy that reduces installments for 10 years after obtaining the loan. SGB Bank S.A. is one of the banks where one can apply for such a loan. Other banks include Bank PKO BP, Bank Pekao S.A., Alior Bank, Santander Bank, Bank Ochrony Środowiska (BOŚ), Bank Polskiej Spółdzielczości, and VeloBank.

We have been working with SGB Bank S.A and the community banks in the SGB group since 2016, and have so far implemented numerous projects, such as:

This project was therefore a natural consequence of the previous projects that the bank was satisfied with.

The biggest challenge in this project was to deliver results in a short time. While we were developing the process, the bank was working out the business arrangements with Bank Gospodarstwa Krajowego (BGK), the entity that handles government subsidies for banking products.

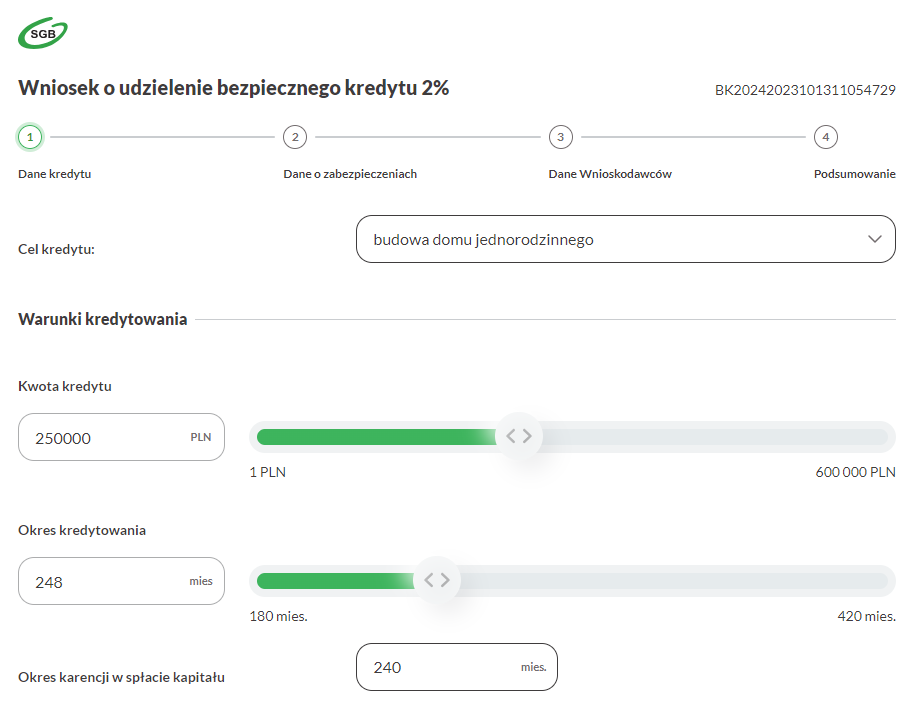

We started by analyzing the aforementioned paper forms and redesigning them for digital channels. Digital forms have completely different mechanics than paper ones – they can include conditioning and other dynamic elements.

There were some challenges on the way, though. After designing the first versions of the forms, substantial changes were made by the regulator, affecting, e.g., form dictionaries. However, thanks to the Eximee platform that enables standardization and reusability of components, it did not cause delays.

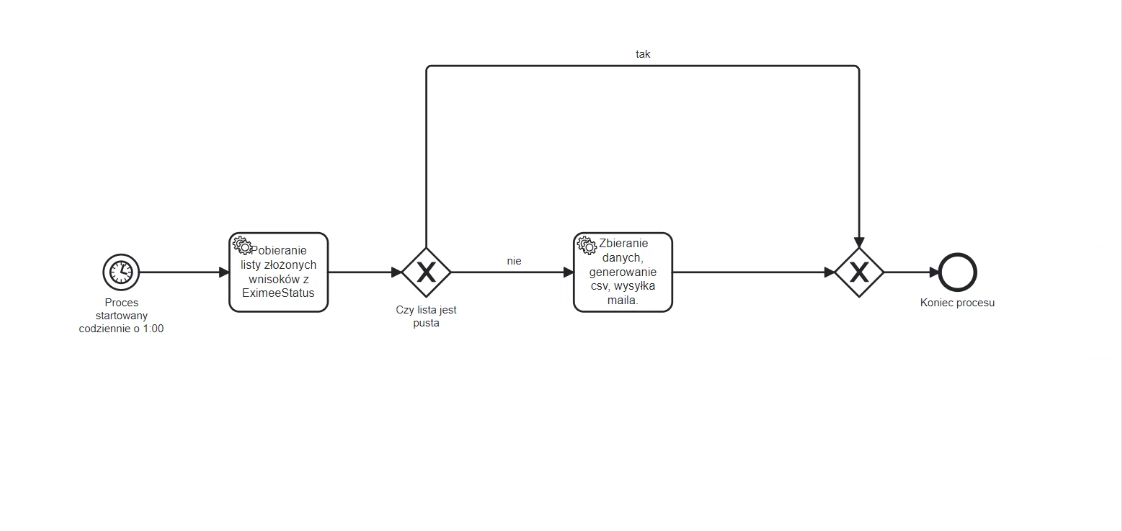

For the Eximee team, the most common approach is to work on a Minimum Viable Product, or as we should say in this case, Minimum Viable Process. The idea is to release an end-to-end process that can later be extended with additional integrations or sub-processes.

Our aim was to enable the application for and purchase of banking products in the shortest possible time. Further down the line, the Eximee platform allows us to identify the most problematic points in the process from both the customer's and the bank's perspective.

With this approach, we could deliver process increments to production quickly and frequently. Therefore, the first process was simple:

Creating the forms for customers wouldn't have been as smooth if we hadn't used the ready-made components offered by our Eximee Front-End Designer. Standardized interface elements can be quickly dragged and dropped in the editor to assemble the required form. We then adapted the forms to the bank's visual identity (style guide), et voilà! – the forms were ready.

The project lasted 2 weeks and had 2 low-code developers working on it. On the home stretch, they were supported by 3 Java developers for 2 days. Right from the start, our assumption was that once the process was available to customers, we would iterate further improvements and expand the MVP.

Digitization of the process at SGB Bank S.A. is a solid base for further enhancements. These may include:

Make an appointment for a discovery meeting and find out how we can help you.