Michał Stolarski

Michał Stolarski

In financial services, customer experience (CX) is often the key factor in choosing a bank. This article explores how low-code platforms contribute to delivering an outstanding CX for bank customers.

Customers expect swift access to new features, services, and products, making efficient implementation of solutions crucial for a positive CX in banking. Low-code tools are vital in this respect, as they significantly reduce the time to market for new solutions.

The Eximee platform offers pre-built UI components and testing tools for rapid prototyping and implementation of new features and services. Its support for omnichannel processes eliminates the need for separate applications for each channel, further cutting down implementation time. The platform ensures that the user interface and experience remain consistent across all channels. Customers can interact with the bank through their preferred channel, enjoying a familiar UI and a consistent UX.

Solutions developed on low-code platforms can be quickly and affordably modified without extensive development resources. Changes can be implemented outside the release cycle and without disrupting application availability, allowing banks to adapt swiftly to regulatory changes, market trends, spikes in demand for specific products and services, or customer feedback.

Customers expect intuitive online banking and mobile applications, where features are easily accessible and effortless to use.

The Eximee platform offers UI components designed in compliance with WCAG and EAA guidelines, along with a simulator for testing the front end across various devices. By prioritizing usability and accessibility, especially for users with disabilities, Eximee enhances the overall user experience for all customers of banking applications.

Moreover, process templates and a business process modeling tool in BPMN facilitate the creation of intuitive solutions with optimal user experience. The Eximee platform can be integrated with user behavior monitoring and analysis tools to help identify areas for improvement.

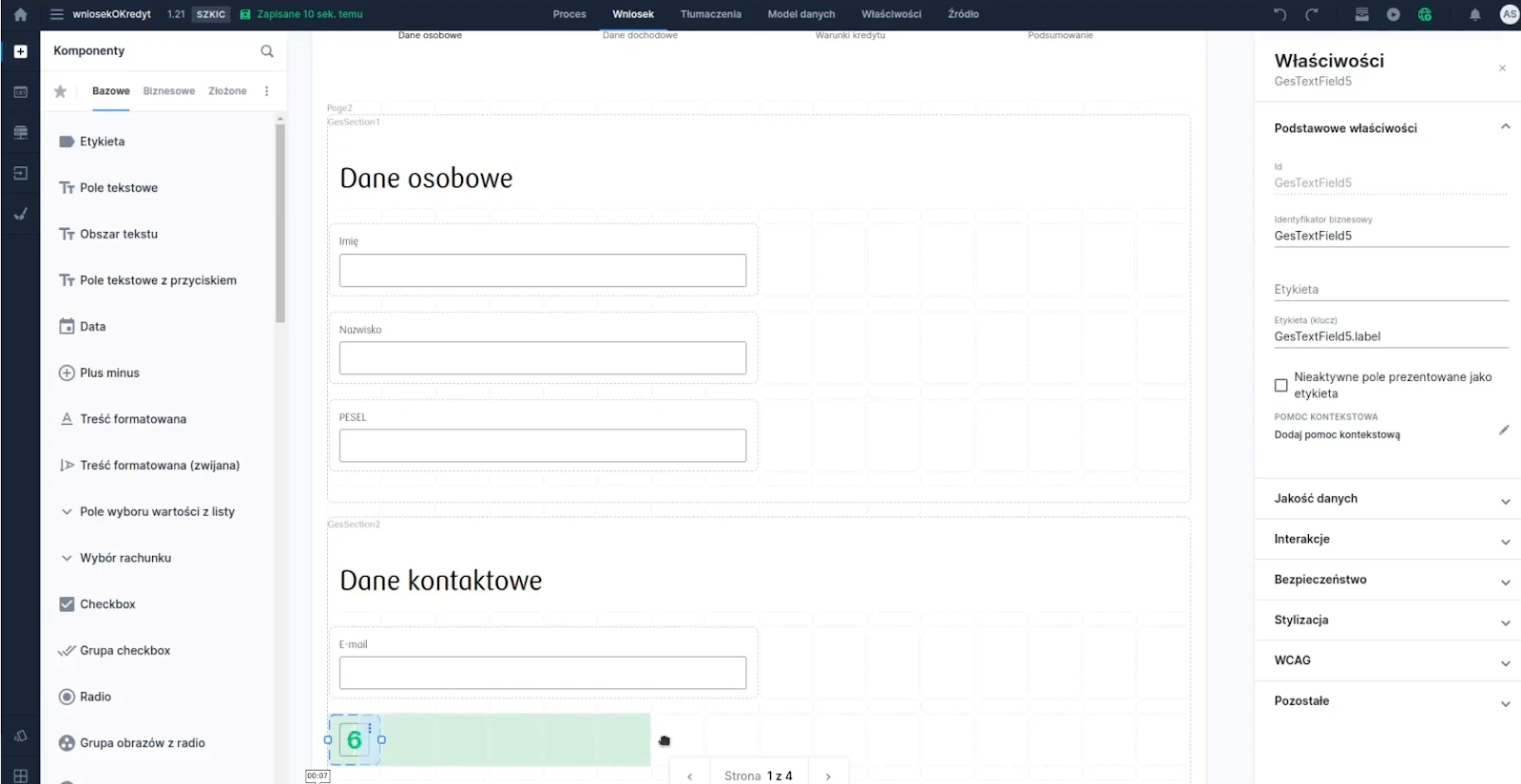

Creating applications in Eximee Designer

Responsive service and efficient support are crucial elements of the banking customer experience (CX). Customers anticipate immediate activation of products upon purchase and expect banks to provide efficient issue resolution, whether at branches, call centers, or through remote channels.

The Eximee platform contributes to meeting these expectations by enabling the separation, automation, and reuse of sub-processes. Automation reduces process completion times, leading to heightened customer satisfaction.

An integral part of customer service is the development of self-service processes, empowering customers to manage their issues online. The Eximee platform excels in constructing self-service processes and customer portals, offering convenient access to banking services across multiple channels. The Eximee Form itself is part of a full-featured application that allows a customer to handle an issue from start to finish, eg. file a complaint or update ID card information. It provides contextual information on process status, visualizing the steps in the process with an indication of a point where the customer is, or providing communications like Verification will take about 15 minutes. Once completed, we will send you a push notification. Business application support spans multiple channels and sessions, ensuring uninterrupted assistance.

However, customers expect to access professional assistance from the bank whenever they encounter problems or have questions. Therefore, consultants must have access to comprehensive information about customers and their issues to provide effective support.

The Eximee platform facilitates seamless and secure integration of existing channels and adopts a unified data model, ensuring smooth data flow between channels. The Eximee Case Repository module aggregates customer and case information from all service channels, offering employees a holistic view of each case within the Eximee Dashboard. This comprehensive dataset empowers them to deliver accurate information and promptly address customer concerns, resulting in enhanced service quality and efficiency.

Personalization is the pivotal factor in fostering a positive customer experience (CX) in banking. Platforms like Eximee empower banks to understand customers’ needs and deliver tailored services and products when they are most needed, e.g. providing a quick cash loan when a customer attempts a transaction with insufficient funds in their account.

Low-code platforms further enhance personalization by consuming data gathered from AI and big data systems. This data is analyzed to personalize marketing content, product offerings, and features within banking applications, aligning them with individual customer preferences and needs.

An integral component of the Eximee platform is the Customer Service Zone – a dedicated space where customers can explore self-service options for active products, check case statuses, view product offerings matching their scoring, and access marketing content that may pique their interest. It facilitates quick access to information, features, and services that are specifically relevant to a particular customer.

Good customer experience hinges on a sense of security. Banks must ensure top-notch data protection and defense against cyber threats and fraud.

The Eximee platform undergoes regular security audits by independent firms and includes built-in security features such as authorization, authentication, access controls, and data encryption. It can also integrate tools for monitoring and analyzing user activity, allowing for quick detection of suspicious behavior and security incidents.

Developing applications on the Eximee platform doesn’t require low-code developers to be security experts. While security awareness is crucial, the platform itself ensures the security of created business applications.

An example of a project implemented on the Eximee platform, which, among other things, aimed to improve CX, is the remote mortgage application process at Credit Agricole Bank Polska. The bank wanted to make the process as streamlined and personalized as possible for requestors.

The starting point was a customer journey developed by the bank and a business process mapped on the Eximee platform. Thanks to Eximee Designer, scripts, and the ability to preview the look of the application, low-code developers created clear forms and user screens in line with UI/UX best practices.

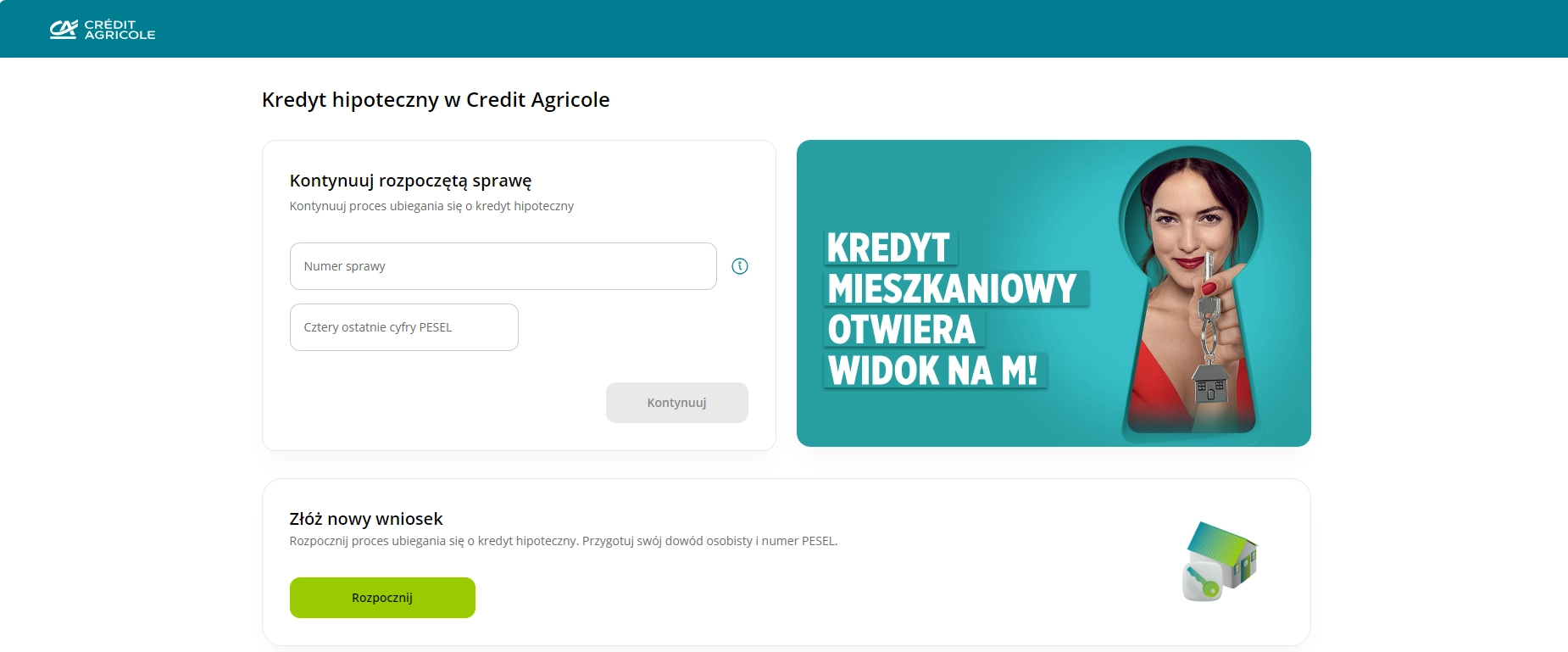

The bank used the Customer Panel, which allows individuals who are not yet customers of the bank to start the process in any digital channel. When logging in to the panel, a user authenticates with a code sent in an SMS. They can complete parts of the form and return to it later, attach files, and review documents provided by the bank. If the bank’s experts find that any data or documents are missing, the panel guides the user on what needs to be added. The Customer Panel also provides real-time updates on the status of the case.

Customer Panel login screen

The process is designed to be completed conveniently “from the couch," while still allowing customers to get support from mortgage experts at any branch or via the infoline at any time. With the Eximee Dashboard, advisors and analysts have a task management tool that gives them access to the same data, documents, and case status information. It enables them to reliably inform clients and assist them through the process, ensuring top-notch service.

It’s essential to note that applying for a mortgage involves sharing a lot of sensitive data and documents. Thus, the process must be not only fast and user-friendly but also secure. The Eximee low-code platform includes procedures for verifying the applicant’s identity and safeguarding data against unauthorized access.

The bank has introduced the solution in a pilot phase, with full implementation planned for September this year.

Customers expect swift access to new features and services. Low-code platforms streamline the development process, reducing the time to market for new solutions and ensuring that banks can meet customer expectations efficiently.

Low-code platforms like Eximee support omnichannel processes, ensuring that the user interface and experience remain consistent across all channels. This allows customers to interact with the bank through their preferred channel, enjoying a familiar UI and a seamless UX.

Low-code platforms enhance customer service by enabling the automation and reuse of sub-processes, reducing process completion times and improving service efficiency. They also support the development of self-service processes, allowing customers to manage their issues online with ease.

Low-code platforms use data from AI and big data systems to personalize marketing content, product offerings, and features within banking applications. This ensures that customers receive tailored services and products that meet their specific needs and preferences.

Low-code platforms include built-in security features such as authorization, authentication, access controls, and data encryption. Regular security audits and integration with monitoring tools help detect and respond to suspicious behavior quickly, ensuring robust data protection.